Start-up technology ventures are exploiting Financial

Services with a flurry of Fintech firms posing a threat to big banks. Broker-dealer

firms, RIA’s, and wealth fund managers are feeling it too.

The staying power of Fintech Firms

Emerging Fin-tech firms are faster at innovation and willing to

accept low margins as a cost of entry to the market. They have also benefited

from slow-to-react regulatory authorities blinded by the word technology even

as many cross over into risk based financial dealings. One strategy of Fintech’s

is to offer niche solutions to customers; such as mobile bill payment

solutions, peer-to-peer lending, and digital currency. As their subscriber base

grows, they offer more and more services, pulling clients away from banks and traditional

investment firms and into a fold of multi-layered solutions.

Some say Fintech firms will pull back when regulators catch

up and start mandating oversight with examinations, monthly reports, and minimum

net capital requirements. More likely, technology firms will come up with innovative

technology and reporting features to satisfy regulator cries for control. As a compliance consulting firm, we’re seeing

an influx of #regtech solutions (also called regulatory technology) for

compliance and audit management.

FINRA release: March 2016 Report on Digital Investments Advice

Office of Comptroller of the Currency release: April 2016 Responsible Innovation for Federal Banking System

As emerging trends gain ground, regulators have taken note

by releasing a series of recommendations and white papers about the Fintech

surge, urging sound risk management and investor protection standards. Why are

Fintech firms able to evolve and grow so fast? Economies of limited scope and awesome

technical resources are one good reason. Here's more -

- Private investors and non-public, pre IPO entities give leaders more control

- Limited focus on only one or two good ideas, for now…

- Specialized workforce with technical skill and experience in emerging technology

- Starting with new technology and platforms rather than adding on top of slower legacy platforms and procedures

How Investment & Brokerage firms get involved with Fintech Solutions

Securities firm executives are asking themselves how can I

get on board with a Fintech strategy that captures the new breed of market

share who doesn’t care if they ever talk to a human being at my firm, wants

real-time data, and access to their account everywhere they go.

Get started with your own #FintechStrategy

Determine a goal. Firms first need

to decide on a strategy and then discuss action to implement a Fintech business

plan. A team should collectively decide the role technology will take such as;

- Reduce overhead costs – (i.e. replace an employee with technology)

- Drive revenue – (i.e. pay per transaction service)

- Add Value, Client Retention – (i.e. convenience services; mobile stock alerts, text transactions)

Research Fintech business models.

Consumers receive value from all kinds of technological advances including; the

internet of things, mobile access to the web. They expect access to real-time data,

and efficient on the go solutions. Many prefer talking to machines as opposed

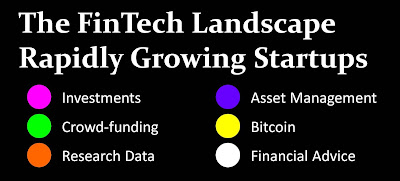

to people. There’s a variety of Fintech sector firms that securities businesses

are suited to launch or participate in. Here's a few examples -

- Retail Investments – Sigfig, Wealthfront, FutureAdvisor

- Institutional Investments – Stocktwits, SumZero, HedgeSPA

- Financial Research – Stocktagon, Q

- Consumer Banking – Gobank, Simple

- Business Tools – Zen Payroll, Xero Accounting

- Online Lending – Orchard Bank, Lending Club, Prosper

- Personal Finance – HelloWallet, BillGuard, CreditKarma

- Payments – Paypal, Wepay, Stripe

- Equity Financing – Seedinvest, EquityNet

Firms may also choose a less involved strategy like

purchasing or investing in a Fintech firm by way of crowd-funding or a strategic

partnership. Large banks and technology companies are already doing this. For

instance, Google Ventures is heavily invested in the automated robo-advisor

service “Robinhood”, while Goldman Sachs is backing “Motif-Investing”. One

advantage to this strategy is the technology skill set is already in place.

Understand your target customer. Client investors these days

are looking more and more for firms they can engage with. Consumers want

real-time insight and advice. They’re highly mobile, active on social media,

and enjoy participation in peer-to-peer structures.

In looking at your Fintech plan, think in terms of what you’re

capabilities are today and where you would like them to be in the future. From

there, draft out a strategy to reach this goal. Consider that the differentiation

between Fintech firm types is blurred. Many services cross-over into other

unanticipated uses. Anticipate the unexpected. For instance, smarter, faster trade solutions

can lead to clients wanting simpler ways to raise money for investing, or

access to simulated investment training, or even virtual reality trade exchanges.

Online wealth portfolio management services can lead to a need for integrated

banking solutions and on demand mobile money platforms.

Take a look at your target market and anticipate what future

needs will be or what needs are not being filled today. Develop a vision for

your future business model that relies on new revenue drivers. Ask yourself

what role technology can play in the business model.

From there move forward to elements of the Fintech business model

considering; budget and cost structure, revenue stream, and changes in overhead

or organizational structure. With these elements in place, teams can decide if

they want to build or enhance systems already in place, or invest in a Fintech

firm. Some firms can develop a strategic partnership to launch their idea.

The best ideas will usually include; cloud computing capability,

client pay-as-you-go services, or strategic vendor relationships.

RND Resources Inc is a compliance and audit consulting firm

to the securities industry. We provide scaleable, integrated solutions for risk

management and compliance. Visit our website for more details www.finracompliance.com/services

We assist securities firms with a suite of regulatory

compliance support programs;

- FINRA New Member or Change applications: NMA, CMA FINRA applications

- Financial Reporting & FinOps: FOCUS filing and related schedules, Annual Assessment reports

- Compliance Services: Procedures & Policies WSP, Advertising review, Annual Compliance Reviews, Outsourced CCO Principal Service

- Audit Services: FINRA regulatory examinations, Certified BD Audits, Custody Audit, AML review, Custody Exams

- FINRA Notice, Sanction, Complaints & Arbitration: Respond to regulatory notices, Customer complaint filings, Forensic Accounting, Expert Witness Service

- Cybersecurity Consulting: Procedure and planning, vendor management, staff training

- Fintech Consulting: Regulatory Compliance Consulting and Support Services for Financial Technology firms; Development and strategy consulting for Fintech entry firms

RND Resources Inc is a proud member of McGladrey Alliance.

McGladrey is a leading provider of middle market audit, tax, and consulting

services. This strategic membership gives us the competitive advantage of

access to audit, technology, research, and tax planning tools. As a full

service compliance firm for middle market brokerages and investment advisors,

we’ll be able to serve clients with robust solutions and trusted technology

platforms. McGladrey Alliance has global capabilities with professionals able

to assist from over 100 countries. Visit our website for more details: http://www.finracompliance.com/about-us/mcgladrey-alliance-member/

No comments:

Post a Comment

Your comments are welcome: